Healthcare Financial Services IG Edition 1 - Local Development build (v1.0.0) built by the FHIR (HL7® FHIR® Standard) Build Tools. See the Directory of published versions

The Kingdom of Saudi Arabia is a large arid country with a population of about 34 million, made up of approximately 22 million citizens and 12 million expatriate residents. The healthcare system in Saudi Arabia is comprised of a public system operated and funded by the Ministries of Health, National Guard and Education, and a private system based on private healthcare delivery organizations and private health insurance companies and Third Party Administrators (TPAs).

Saudi regulations require that employers provide health insurance to all of their employees, including Saudi citizens, and regulate the participation of both private and public provider organizations in the exchange of eClaims and related information with the private insurance industry. Currently (October 2025) the Council for Health Insurance regulates the health insurance industry with 6,600 provider organizations and 28 insurers and 8 TPAs which together service about 14.1 million beneficiaries - expatriates and Saudi citizens employed in private industry, and 18.8+ million visitors.

Historically each provider organization developed their own codes for such activities as billing and information management and selected their own codes for ordering, diagnosis and such inter-organization exchanges. This has resulted in a lack of efficiency, and lack of interoperability and a barrier to modernization of the financial and clinical aspects of digital healthcare in the country. Beginning in about 2012, the leading regulators of the Saudi healthcare system: Council for Health Insurance (CHI) for financial exchanges and the Ministry of Health (MOH) for clinical exchanges began formulating models to put in place to support a modern, efficient, interoperable digital health system. The financial system was called SHIB - the Saudi Health Insurance Bus, and the clinical system was called SeHE - the Saudi Electronic Health (data) Exchange. These programs were later brought together under the current program name nphies - the National Platform for Health Information Exchange Services.

|

|

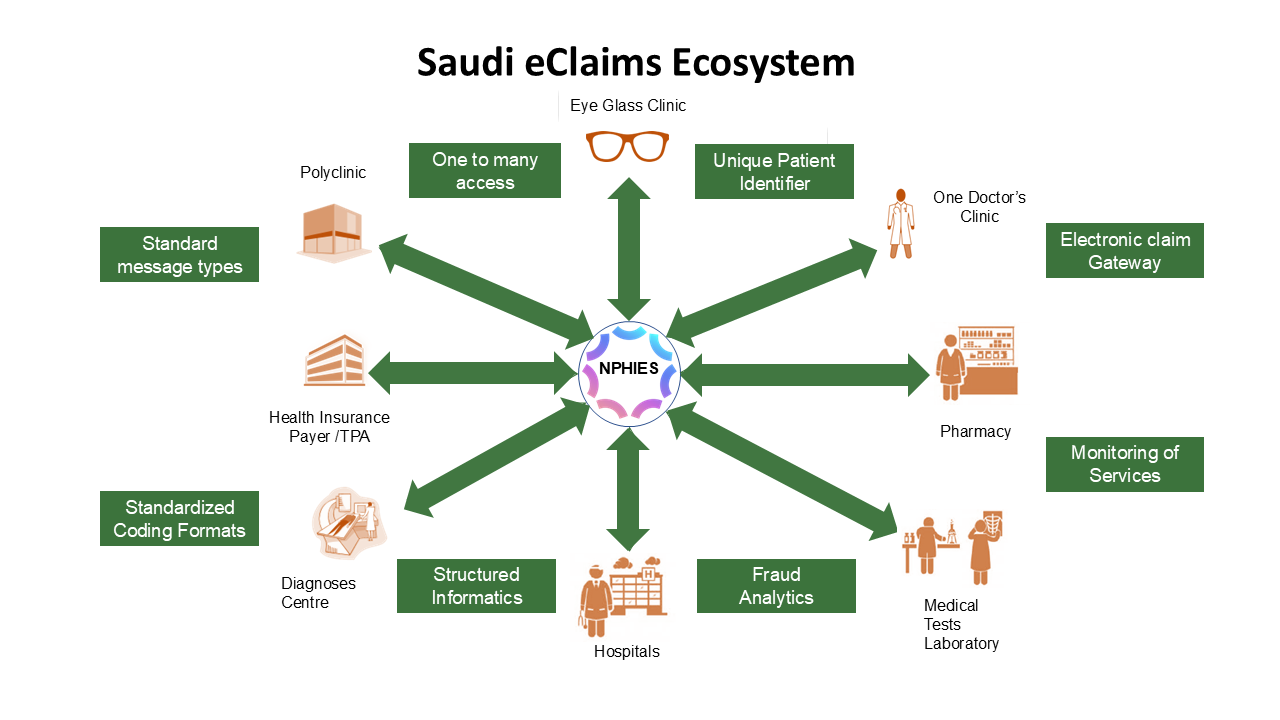

nphies functions as a single point of contact for all providers, insurers and TPAs for the exchange of eClaims and clinical information as depicted below. Currently all of the private insurers and/or their TPAs and most of the 6,600 regulated provider organizations exchange all of their eClaims transactions via the nphies system. The public health system has joined the nphies environment and will continue to add public providers as it transforms itself into a national insurer. Any of the approximately 18,000 Saudi healthcare provider organizations which have not already joined nphies may also connect to nphies.

This implementation guide provides the standards used by all parties for the exchange of financial (eClaims) information. The objective is to enable payers (HICs (insurers) and TPAs) and providers (HCPs) to integrate with nphies for the exchange of eClaims. The guide provides an overview of nphies, the information exchange construction (messaging), the Use Case information flow between different healthcare stakeholders and nphies, defines the message structures, and provides links to relevant FHIR artifacts and documentation.

nphies is a centralized validating standards-based information exchange gateway to connect all healthcare providers and payers within KSA. Its role is to support the market in providing timely, efficient, and cost-effective information exchange services to providers of healthcare services, clinical and insurance, in Saudi Arabia.

Breaking this down:

Summarizing the above points, nphies is a single point of contact platform to which all HCPs and HICs may connect to exchange standards-based messages where nphies will validate the form and content of those messages to maximize the validity, the standards and compliance of those information exchanges.

The nphies will retain copies of information exchanges to support the market and regulators such as CHI in dispute resolution, in understanding market health and the management of the regulatory processes.

When a provider does not already know which insurers have policies for a patient they may access the HIDP-API, Health Insurance Data, to obtain a list of insurers having policies for the patient. For more information, refer to the document Beneficiary Discovery Insurance HIDP Guideline in the documentation folder on the nphies unified portal.